Market Beta Percentage . Here is a straightforward formula for calculating the beta coefficient of a stock:. The market benchmark index sits at a. For example, a beta of 1.3 suggests that the stock is. The overall market has a beta of 1.0, and individual stocks are. beta is a measure of a stock’s volatility relative to the market as represented by a benchmark (usually the. how to read stock betas. It is calculated using two specific components,. it is calculated as follows: Beta is a numerical value. Beta indicates how volatile a stock's price is in comparison to the overall stock market. The beta formula is relatively simple. a beta higher than one shows that a stock’s price is more volatile than the market. 6 steps to calculate the beta of a stock.

from www.chegg.com

it is calculated as follows: Beta indicates how volatile a stock's price is in comparison to the overall stock market. It is calculated using two specific components,. For example, a beta of 1.3 suggests that the stock is. Beta is a numerical value. beta is a measure of a stock’s volatility relative to the market as represented by a benchmark (usually the. The market benchmark index sits at a. 6 steps to calculate the beta of a stock. a beta higher than one shows that a stock’s price is more volatile than the market. how to read stock betas.

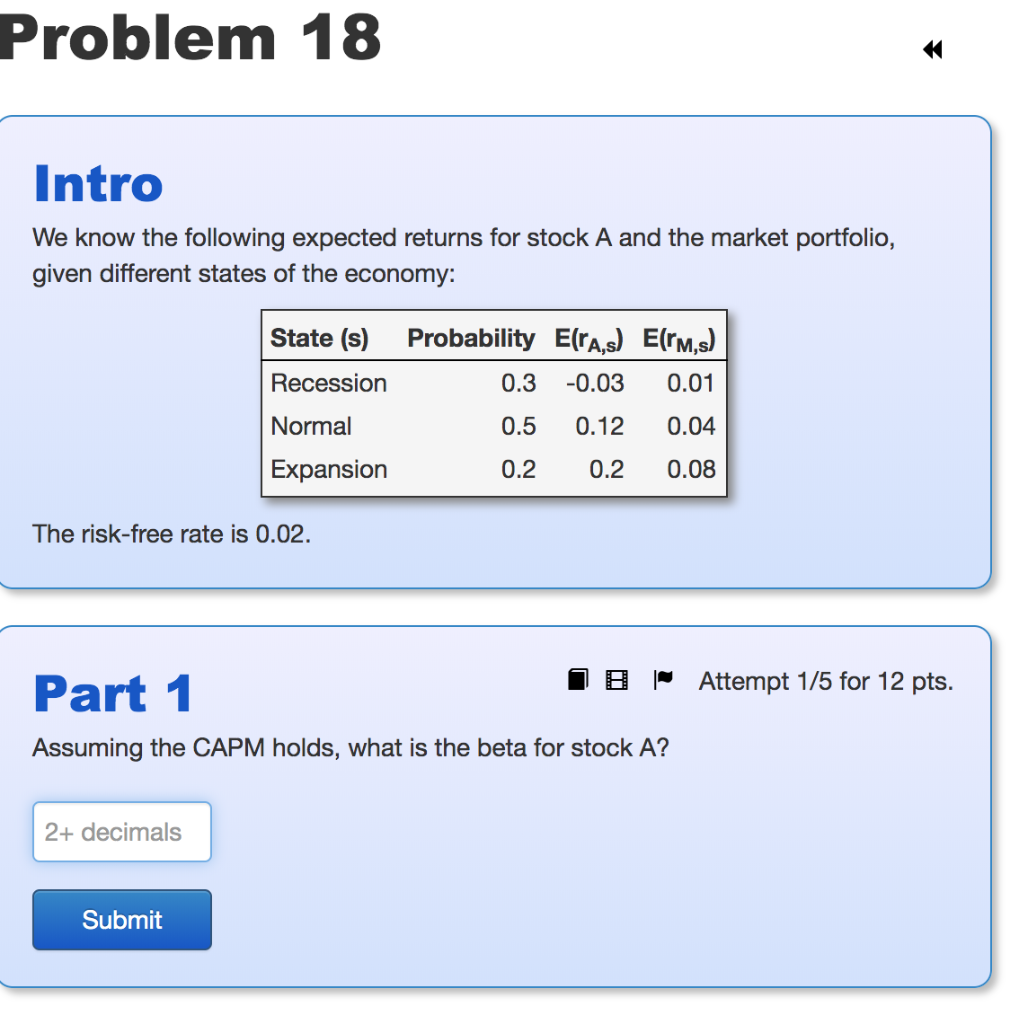

Solved Problem 14 Intro A stock has a beta of 1.3. The

Market Beta Percentage how to read stock betas. a beta higher than one shows that a stock’s price is more volatile than the market. Beta is a numerical value. The market benchmark index sits at a. The overall market has a beta of 1.0, and individual stocks are. For example, a beta of 1.3 suggests that the stock is. 6 steps to calculate the beta of a stock. beta is a measure of a stock’s volatility relative to the market as represented by a benchmark (usually the. The beta formula is relatively simple. it is calculated as follows: Beta indicates how volatile a stock's price is in comparison to the overall stock market. Here is a straightforward formula for calculating the beta coefficient of a stock:. It is calculated using two specific components,. how to read stock betas.

From www.slideserve.com

PPT Weighted average cost of capital PowerPoint Presentation, free Market Beta Percentage Beta is a numerical value. how to read stock betas. 6 steps to calculate the beta of a stock. a beta higher than one shows that a stock’s price is more volatile than the market. beta is a measure of a stock’s volatility relative to the market as represented by a benchmark (usually the. It is. Market Beta Percentage.

From www.slideserve.com

PPT CHAPTER 6 Risk and Rates of Return PowerPoint Presentation, free Market Beta Percentage For example, a beta of 1.3 suggests that the stock is. It is calculated using two specific components,. it is calculated as follows: The market benchmark index sits at a. The beta formula is relatively simple. 6 steps to calculate the beta of a stock. Beta is a numerical value. The overall market has a beta of 1.0,. Market Beta Percentage.

From blog.dhan.co

What is Beta in Stock Market Definition, Calculation & Uses Dhan Blog Market Beta Percentage it is calculated as follows: Here is a straightforward formula for calculating the beta coefficient of a stock:. how to read stock betas. The beta formula is relatively simple. 6 steps to calculate the beta of a stock. Beta is a numerical value. beta is a measure of a stock’s volatility relative to the market as. Market Beta Percentage.

From www.wikihow.com

How to Calculate Beta (with Pictures) wikiHow Market Beta Percentage For example, a beta of 1.3 suggests that the stock is. it is calculated as follows: Beta is a numerical value. It is calculated using two specific components,. 6 steps to calculate the beta of a stock. The overall market has a beta of 1.0, and individual stocks are. a beta higher than one shows that a. Market Beta Percentage.

From mavink.com

Beta Spring Rate Chart Market Beta Percentage The market benchmark index sits at a. how to read stock betas. Beta indicates how volatile a stock's price is in comparison to the overall stock market. It is calculated using two specific components,. it is calculated as follows: The beta formula is relatively simple. 6 steps to calculate the beta of a stock. The overall market. Market Beta Percentage.

From www.wikihow.com

How to Calculate Beta (with Pictures) wikiHow Market Beta Percentage it is calculated as follows: It is calculated using two specific components,. a beta higher than one shows that a stock’s price is more volatile than the market. beta is a measure of a stock’s volatility relative to the market as represented by a benchmark (usually the. The beta formula is relatively simple. Here is a straightforward. Market Beta Percentage.

From www.cnbc.com

Delivering beta the stocks tracking closest to market Market Beta Percentage The overall market has a beta of 1.0, and individual stocks are. For example, a beta of 1.3 suggests that the stock is. Beta is a numerical value. The beta formula is relatively simple. beta is a measure of a stock’s volatility relative to the market as represented by a benchmark (usually the. how to read stock betas.. Market Beta Percentage.

From www.wikihow.com

How to Calculate Beta (with Pictures) wikiHow Market Beta Percentage The overall market has a beta of 1.0, and individual stocks are. Here is a straightforward formula for calculating the beta coefficient of a stock:. The beta formula is relatively simple. Beta is a numerical value. beta is a measure of a stock’s volatility relative to the market as represented by a benchmark (usually the. For example, a beta. Market Beta Percentage.

From www.chegg.com

Solved A stock has an expected return of 10.45 percent, its Market Beta Percentage For example, a beta of 1.3 suggests that the stock is. Beta is a numerical value. The overall market has a beta of 1.0, and individual stocks are. 6 steps to calculate the beta of a stock. The beta formula is relatively simple. Beta indicates how volatile a stock's price is in comparison to the overall stock market. It. Market Beta Percentage.

From www.numerade.com

SOLVED You are trying to calculate the beta for a stock by using data Market Beta Percentage The beta formula is relatively simple. how to read stock betas. The overall market has a beta of 1.0, and individual stocks are. For example, a beta of 1.3 suggests that the stock is. It is calculated using two specific components,. The market benchmark index sits at a. Beta is a numerical value. Here is a straightforward formula for. Market Beta Percentage.

From www.scribd.com

Calculation of Beta in Stock Markets Beta (Finance) Capital Asset Market Beta Percentage The beta formula is relatively simple. Here is a straightforward formula for calculating the beta coefficient of a stock:. it is calculated as follows: The overall market has a beta of 1.0, and individual stocks are. beta is a measure of a stock’s volatility relative to the market as represented by a benchmark (usually the. how to. Market Beta Percentage.

From www.researchgate.net

Market beta (The results of market model) Download Scientific Diagram Market Beta Percentage Here is a straightforward formula for calculating the beta coefficient of a stock:. it is calculated as follows: Beta is a numerical value. For example, a beta of 1.3 suggests that the stock is. The overall market has a beta of 1.0, and individual stocks are. 6 steps to calculate the beta of a stock. Beta indicates how. Market Beta Percentage.

From www.researchgate.net

Average upmarket and downmarket betas per unit of average CAPM beta Market Beta Percentage 6 steps to calculate the beta of a stock. It is calculated using two specific components,. The overall market has a beta of 1.0, and individual stocks are. how to read stock betas. For example, a beta of 1.3 suggests that the stock is. Here is a straightforward formula for calculating the beta coefficient of a stock:. The. Market Beta Percentage.

From corporatefinanceinstitute.com

Unlevered Beta (Asset Beta) Formula, Calculation, and Examples Market Beta Percentage For example, a beta of 1.3 suggests that the stock is. a beta higher than one shows that a stock’s price is more volatile than the market. It is calculated using two specific components,. Beta is a numerical value. Beta indicates how volatile a stock's price is in comparison to the overall stock market. it is calculated as. Market Beta Percentage.

From avgjoefinance.com

You May Also Like Market Beta Percentage The overall market has a beta of 1.0, and individual stocks are. Here is a straightforward formula for calculating the beta coefficient of a stock:. Beta is a numerical value. For example, a beta of 1.3 suggests that the stock is. Beta indicates how volatile a stock's price is in comparison to the overall stock market. it is calculated. Market Beta Percentage.

From www.efinancialmodels.com

Public Equity Beta Adjustor Excel Template eFinancialModels Market Beta Percentage beta is a measure of a stock’s volatility relative to the market as represented by a benchmark (usually the. Beta is a numerical value. how to read stock betas. The beta formula is relatively simple. it is calculated as follows: a beta higher than one shows that a stock’s price is more volatile than the market.. Market Beta Percentage.

From slideplayer.com

The McGrawHill Companies, Inc., ppt download Market Beta Percentage beta is a measure of a stock’s volatility relative to the market as represented by a benchmark (usually the. For example, a beta of 1.3 suggests that the stock is. 6 steps to calculate the beta of a stock. how to read stock betas. it is calculated as follows: a beta higher than one shows. Market Beta Percentage.

From www.chegg.com

Solved Problem 14 Intro A stock has a beta of 1.3. The Market Beta Percentage Beta indicates how volatile a stock's price is in comparison to the overall stock market. Beta is a numerical value. It is calculated using two specific components,. a beta higher than one shows that a stock’s price is more volatile than the market. Here is a straightforward formula for calculating the beta coefficient of a stock:. how to. Market Beta Percentage.